The Reserve Bank of Australia (RBA) has kept the nation's interest rates on hold, but experts have warned borrowers not to breathe a sigh of relief yet.

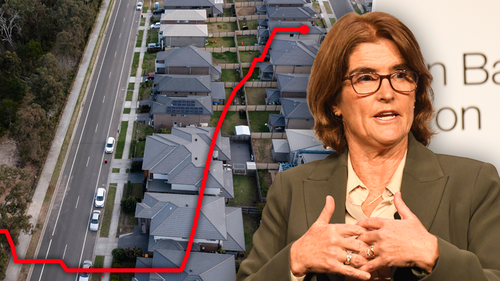

Today the newly appointed RBA Governor Michele Bullock, along with the RBA board, said the nation's official cash rate target would be kept on hold at 4.10 per cent.

October's pause marks the fourth month in a row in which the RBA has kept the cash rate steady, with the central bank again citing the need to see more data before changing the nation's cash rate.

In her maiden monetary statement Bullock said the RBA was closely watching the rate of inflation in Australia, and that more rate hikes may be required.

"Some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe, but that will continue to depend upon the data and the evolving assessment of risks," she said.

"In making its decisions, the Board will continue to pay close attention to developments in the global economy, trends in household spending, and the outlook for inflation and the labour market.

"The Board remains resolute in its determination to return inflation to target and will do what is necessary to achieve that outcome."

This cottage just sold for nearly $5 million

Graham Cooke, head of consumer research at Finder, said many experts do not believe that we have seen the peak of the RBA's rate-hiking cycle.

"A fourth consecutive rate hold from the RBA will be welcome news to mortgage holders, many of whom are struggling with higher repayments," he said.

"While homeowners have been given a break, stubborn inflation means we could still see another rate hike before Christmas."

The most recent CPI monthly data showed a modest rise to 5.2 per cent, however the board noted that much of this increase was driven by volatile items such as fuel and produce costs.

Bilgehan Karabay, Associate Professor of Economics at RMIT University, said today's pause does not mean Australians currently suffering with living costs are in the clear.

"The tight rental market means rental prices will continue to put pressure on inflation," Karabay said.

"In addition, house prices seem to have plateaued, which is due to two effects that offset each other – on the one hand, high interest rates decrease loan applications and curb demand, on the other, high construction costs limit housing supply.

"Markets see the possibility of another rate hike in the US until the end of this year. In addition, rates will stay higher for longer.

"Other economies, including Australia, also face the same risk. The Australian dollar recently depreciated against the US dollar, which could create further inflationary pressures through our imports."